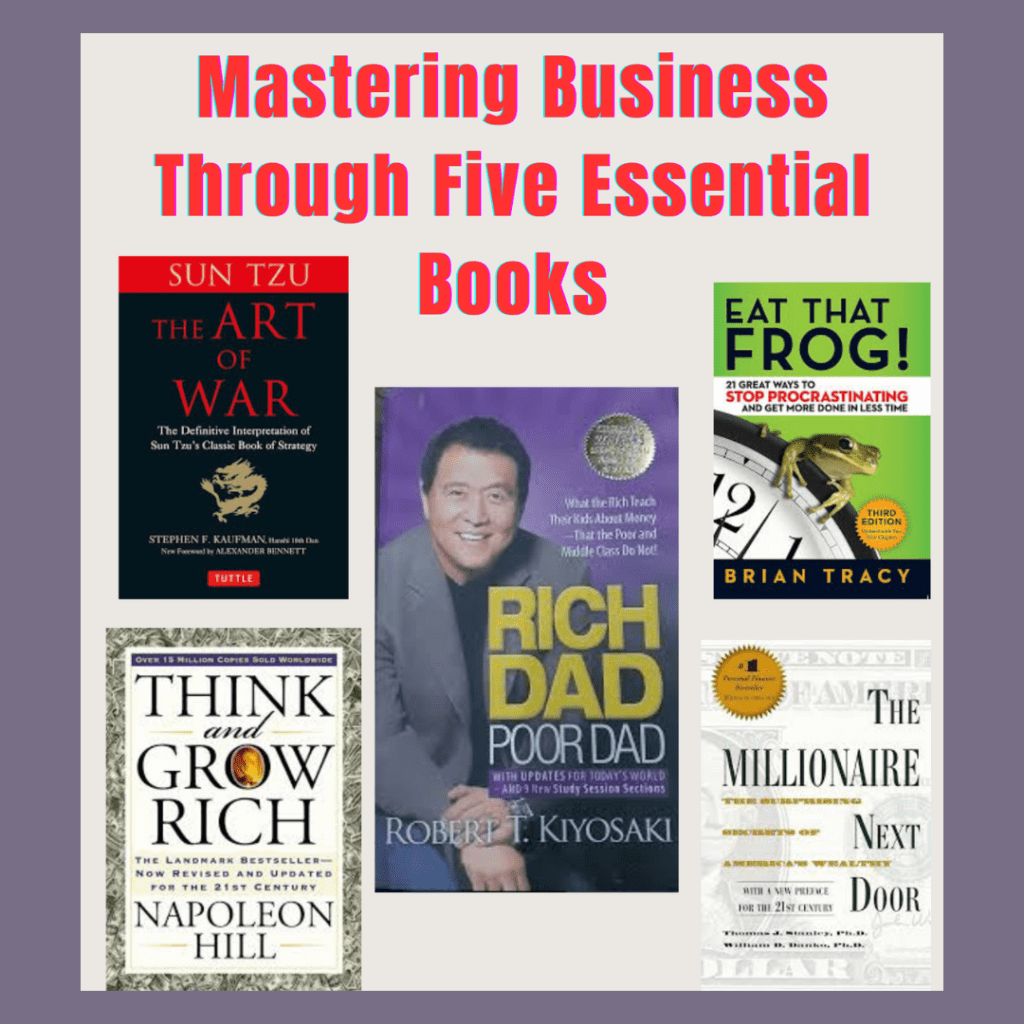

We live in a world drowning in information, a relentless torrent of “hacks,” “secrets,” and “guru” advice promising instant success. Yet, true, sustainable achievement in business isn’t built on fleeting trends or overnight sensations. It’s forged on the bedrock of timeless principles—principles that have guided successful businesses for generations.

What if I told you there was a way to bypass the noise, to cut through the clutter, and access a concentrated dose of this essential wisdom? Not a shortcut to riches, mind you, but a shortcut to understanding the core mechanics of business success. This isn’t about chasing the latest fad; it’s about building a foundation that will withstand the test of time. This isn’t just a reading list; it’s a carefully curated curriculum for mastering the game of business.

Chapter 1: Decoding the Language of Money (Rich Dad, Poor Dad)

Robert Kiyosaki’s Rich Dad, Poor Dad isn’t merely a book; it’s a fundamental shift in perspective. It pulls back the curtain on the often-misunderstood world of personal finance, exposing the stark differences in how the rich and the poor approach money. It’s about understanding the rules of the game, rules that are often not taught in traditional education.

Benefit: Understanding the Difference Between Assets and Liabilities: The Cornerstone of Wealth Building:

- This isn’t dry accounting jargon; it’s the very essence of financial intelligence. Kiyosaki’s clear definitions cut through the confusion and empower you to make informed financial decisions.

- Clarity and Simplicity: Kiyosaki demystifies complex financial concepts, making them accessible to everyone.

- Practical Application: Understanding this distinction allows you to focus on acquiring assets that generate income, rather than accumulating liabilities that drain your resources.

- Building a Strong Financial Foundation: This fundamental understanding is the first step towards building true wealth and financial freedom.

- Example: The House as a Liability: Challenging Conventional Wisdom:

- Kiyosaki’s counterintuitive example of a house being a liability, not an asset, for many people challenges conventional wisdom and forces you to re-evaluate your financial decisions. He explains how the ongoing costs of mortgage payments, property taxes, maintenance, and repairs make a house a drain on your cash flow, rather than a source of income.

- Benefit: Learning the Importance of Financial Literacy: Making Your Money Work for You:Rich Dad, Poor Dad emphasizes that it’s not about getting a high-paying job; it’s about making your money work for you. It’s about understanding how money flows, how to manage it effectively, and how to invest it wisely.

- Taking Control of Your Finances: Financial literacy empowers you to take control of your finances, rather than being controlled by them.

- Building Financial Independence: By understanding how to make your money work for you, you can build financial independence and achieve your financial goals.

- Creating Generational Wealth: Financial literacy is not just about personal gain; it’s about building a legacy for future generations.

- Exercise: Create a Personal Balance Sheet: A Revealing Self-Assessment:

- This simple yet powerful exercise can be surprisingly revealing.

- List Your Assets: Identify everything that puts money into your pocket. This could include rental properties, stocks, bonds, business income, and intellectual property.

- List Your Liabilities: Identify everything that takes money out of your pocket. This includes mortgage payments, car loans, credit card debt, and other expenses.

- Analyze Your Balance Sheet: Review your balance sheet and identify areas where you can improve your financial situation. Are you accumulating more liabilities than assets? Are your assets generating enough income?

- Develop a Plan: Based on your analysis, develop a plan to increase your assets and reduce your liabilities.

This exercise provides a tangible starting point for applying Kiyosaki’s principles and taking control of your financial future. It’s the first step to mastering the language of money and building a solid foundation for business success.

Chapter 2: The Power of Thought (Think and Grow Rich)

Napoleon Hill’s Think and Grow Rich is far more than a simple self-help manual; it’s a profound guide to harnessing the immense power of your mind to achieve extraordinary success. It’s a deep dive into the psychology of achievement, revealing the mental processes that separate those who merely dream from those who actively manifest their desires.

- Benefit: Mastering the Art of Goal Setting: The Fuel of Achievement: Vague aspirations and wishful thinking won’t propel you toward success. Clear, defined, and meticulously planned goals are the essential fuel that drives achievement. Hill emphasizes the importance of:

- Specificity: Defining your goals with absolute clarity, leaving no room for ambiguity. What exactly do you want to achieve?

- Measurability: Establishing concrete metrics to track your progress and know when you’ve reached your objective.

- Attainability: Setting challenging yet realistic goals that stretch your abilities without being demoralizing.

- Relevance: Ensuring your goals align with your overall values and long-term vision.

- Time-Bound: Setting clear deadlines to create a sense of urgency and accountability.

- Example: The Power of Written Goals and Visualization: Programming Your Subconscious Mind: Hill’s emphasis on writing down your goals, reading them aloud twice daily (morning and night), and vividly visualizing their achievement is a powerful technique for subconscious programming. This process:

- Reinforces Your Commitment: Writing down your goals makes them tangible and solidifies your commitment to achieving them.

- Engages Your Subconscious: Repeatedly reading and visualizing your goals programs your subconscious mind to work towards their realization.

- Creates a Clear Mental Image: Visualization helps you create a clear mental image of what success looks like, making it easier to identify opportunities and take action.

- Benefit: Cultivating a Burning Desire: The Driving Force Behind Success: This isn’t just fleeting wishful thinking; it’s an unwavering, all-consuming commitment to your vision—a burning desire that fuels your actions and sustains you through challenges. This involves:

- Intense Focus: Maintaining unwavering focus on your goals, even when faced with obstacles.

- Persistence and Resilience: Overcoming setbacks and challenges with unwavering determination.

- Emotional Investment: Connecting with your goals on an emotional level, fueling your motivation.

- Exercise: Write a Clear, Concise Statement of Your Major Definite Purpose: Your Personal Mission Statement: This exercise helps you crystallize your primary goal and create a roadmap for achieving it.

- Be Specific: Clearly define what you want to achieve. Avoid vague statements.

- Set a Deadline: Establish a specific timeframe for achieving your goal.

- Outline a Plan: Break down your goal into smaller, actionable steps.

- Write a Statement: Write a concise statement that summarizes your major definite purpose, including the deadline and key steps.

- Example: “My major definite purpose is to launch my online coaching business by December 31st, 2024. I will achieve this by completing a business plan by March 31st, building my website by June 30th, and launching a marketing campaign by September 30th.”

Chapter 3: The Millionaire Next Door: Unveiling the Secrets of Wealth Creation

Thomas J. Stanley and William D. Danko’s The Millionaire Next Door masterfully debunks the pervasive myth of the flashy, high-spending millionaire. It reveals the surprising truth about how most millionaires actually accumulate their wealth.

- Benefit: Embracing Frugality: The Foundation of Sustainable Wealth: True wealth isn’t about conspicuous consumption, driving expensive cars, or living in lavish mansions; it’s about disciplined saving, strategic investing, and living below your means.

- Living Below Your Means: Spending less than you earn is the cornerstone of wealth accumulation.

- Prioritizing Saving and Investing: Focusing on saving and investing a significant portion of your income, rather than spending it on non-essential items.

- Avoiding Lifestyle Inflation: Resisting the temptation to increase your spending as your income increases.

- Example: The Modest Lifestyle of Most Millionaires: Challenging Stereotypes: The book reveals that the vast majority of millionaires live surprisingly modest lifestyles, driving ordinary cars, living in regular neighborhoods, and avoiding extravagant purchases. This challenges the common stereotype of the wealthy individual.

- Focus on Long-Term Growth: Millionaires prioritize long-term wealth accumulation over short-term gratification.

- Disciplined Spending Habits: They are careful with their spending and make conscious decisions about how they allocate their resources.

- Investing Wisely: They invest their savings wisely, focusing on long-term growth and building a diversified portfolio.

- Benefit: Understanding the Importance of Consistent Saving and Investing: The Power of Compounding: The book emphasizes the profound impact of consistent saving and investing, even in small amounts. The power of compounding over time can lead to significant wealth accumulation.

- The Power of Compounding: Small amounts invested consistently over long periods of time can grow exponentially due to the compounding effect.

- Early Investing: Starting to invest early in life gives your money more time to compound and grow.

- Consistent Contributions: Making regular contributions to your investment portfolio is crucial for maximizing the benefits of compounding.

- Exercise: Track Your Spending for a Month: Identifying Areas for Improvement: This exercise helps you gain a clear understanding of where your money is going and identify areas where you can cut back without sacrificing your quality of life.

- Track Every Expense: For one month, meticulously track every single expense, no matter how small.

- Categorize Your Spending: Group your expenses into different categories, such as housing, food, transportation, entertainment, etc.

- Analyze Your Spending Habits: Review your spending data and identify areas where you can cut back without significantly impacting your quality of life.

- Reallocate Your Savings: Reallocate the money you save to investments that will help you build wealth over time.

These expanded chapters provide a more in-depth understanding of the key concepts from these two influential books and offer actionable steps for readers to apply these principles in their own lives.

Chapter 4: Strategic Thinking: The Art of War for Business

Sun Tzu’s The Art of War, though written centuries ago for military strategy, offers timeless wisdom that is remarkably applicable to the modern business world. It’s not about aggression or conflict in a literal sense, but about strategic thinking, planning, and execution in a competitive landscape.

- Benefit: Mastering the Art of Planning and Preparation: Anticipating the Battlefield: Success in business, much like in warfare, is not about haphazardly reacting to events as they unfold; it’s about meticulously anticipating them, understanding the terrain, and developing a well-defined strategy.

- Strategic Foresight: Developing the ability to anticipate market trends, competitor actions, and potential challenges.

- Scenario Planning: Creating contingency plans for different scenarios to mitigate risks and capitalize on opportunities.

- Intelligence Gathering: Gathering information about your competitors, your market, and your customers to make informed decisions.

- Example: “Every battle is won before it’s fought”: The Power of Preemptive Strategy: This famous quote emphasizes the crucial importance of meticulous planning and preparation before engaging in any competitive action, whether it’s launching a new product, entering a new market, or negotiating a deal.

- Thorough Market Research: Understanding the market landscape, customer needs, and competitive dynamics.

- Detailed Planning and Execution: Developing a comprehensive plan that outlines objectives, strategies, tactics, and timelines.

- Resource Allocation: Allocating resources effectively to support the execution of the plan.

- Benefit: Maximizing Limited Resources: Strategic Deployment of Assets: In business, as in war, resources (time, money, personnel, etc.) are always finite. The key is not simply having resources, but deploying them strategically to achieve maximum impact.

- Focus on Key Priorities: Identifying the most critical areas to allocate resources to achieve your strategic objectives.

- Efficient Resource Allocation: Using resources efficiently to avoid waste and maximize returns.

- Adaptability and Flexibility: Being able to adapt your resource allocation based on changing circumstances.

- Exercise: Analyze a Recent Business Challenge: Applying Strategic Principles: This exercise encourages you to apply the principles of The Art of War to real-world business situations.

- Describe the Challenge: Clearly define the business challenge you faced.

- Analyze the Situation: What were the key factors contributing to the challenge? What were the strengths and weaknesses of your business and your competitors?

- Apply Strategic Principles: Consider how the following principles from The Art of War could have been applied:

- Planning and Preparation: Could better planning have prevented the challenge or mitigated its impact?

- Knowing Yourself and Your Enemy: Did you have a clear understanding of your own strengths and weaknesses and those of your competitors?

- Using Deception and Surprise: Could you have used any strategic maneuvers to gain an advantage?

- Adapting to Changing Circumstances: Were you able to adapt your strategy as the situation evolved?

- Develop Alternative Strategies: Based on your analysis, develop alternative strategies that could have led to a better outcome.

Chapter 5: Productivity Hacks: Getting Things Done (Eat That Frog!)

Brian Tracy’s Eat That Frog! provides practical, actionable strategies for maximizing productivity and overcoming procrastination. It’s about focusing on what truly matters and getting things done efficiently.

- Benefit: Prioritizing Tasks Effectively: Focusing on What Matters Most: Not all tasks are created equal. Effective productivity relies on the ability to prioritize tasks and focus on the most important ones first.

- The ABCDE Method: Tracy’s ABCDE method helps you prioritize tasks based on their importance and consequences.

- The 80/20 Rule (Pareto Principle): Focusing on the 20% of your tasks that will produce 80% of your results.

- Time Management Techniques: Using time management techniques like time blocking and the Pomodoro Technique to improve focus and efficiency.

- Example: The “Eat That Frog” Metaphor: Tackling the Toughest Task First: The central metaphor of the book encourages tackling the most challenging, important, and often unpleasant task (the “frog”) first thing in the morning.

- Overcoming Procrastination: By tackling the most difficult task first, you overcome procrastination and create momentum for the rest of the day.

- Increased Productivity: Completing the most important task early in the day frees up mental energy and allows you to focus on other tasks more effectively.

- Sense of Accomplishment: Completing a challenging task first thing in the morning provides a sense of accomplishment and boosts your motivation.

- Benefit: Overcoming Procrastination: Conquering the Productivity Killer: Procrastination is the enemy of productivity, preventing you from achieving your goals. Eat That Frog! offers practical solutions to overcome this common challenge.

- Breaking Down Large Tasks: Breaking down large, overwhelming tasks into smaller, more manageable steps.

- Setting Clear Deadlines: Setting clear deadlines for each task to create a sense of urgency.

- Eliminating Distractions: Identifying and eliminating distractions that hinder your focus.

- Exercise: Identify Your Biggest “Frog” for Tomorrow: Planning for a Productive Day: This simple exercise helps you start each day with a clear focus on your most important task.

- Identify Your “Frog”: At the end of each day, identify the one task that you are most likely to procrastinate on but that will have the biggest impact on your goals. This is your “frog.”

- Plan to Tackle It First Thing: Make a conscious decision to tackle your “frog” first thing in the morning, before you do anything else.

- Break It Down (If Necessary): If your “frog” is a large task, break it down into smaller, more manageable steps.

These expanded chapters provide a more comprehensive understanding of the key concepts from these two influential books and offer practical exercises that readers can immediately implement to improve their strategic thinking and productivity.

These 13 tips represent a powerful synthesis of the timeless wisdom gleaned from the five essential books we’ve explored. They are not merely isolated pieces of advice but interconnected principles that work together to create a robust foundation for business success.

- Start with a Vision: Define Your “Why”: Before embarking on any business venture, it’s crucial to define your “why”—your driving purpose, your core values, and the impact you want to make on the world. This vision will serve as your compass, guiding your decisions and motivating you through challenges.

- Invest in Financial Education: Become Fluent in the Language of Money: Financial literacy is not just for accountants; it’s a fundamental skill for every business owner. Understanding financial statements, cash flow, and investment strategies is essential for making informed decisions and managing your resources effectively.

- Focus on Execution: Ideas Are Worthless Without Action: Brilliant ideas are only as good as their execution. It’s not enough to have a great concept; you must take consistent action to bring it to life. This requires planning, discipline, and perseverance.

- Build Strong Networks: Your Network Is Your Net Worth: Your network of contacts, mentors, and collaborators can be invaluable in your business journey. Cultivating strong relationships can open doors to new opportunities, provide valuable support, and offer different perspectives.

- Practice Frugality: Live Below Your Means: As The Millionaire Next Door emphasizes, true wealth is not about conspicuous consumption; it’s about disciplined saving and investing. Living below your means allows you to accumulate capital and reinvest it back into your business.

- Stay Adaptable: Be Willing to Change Course When Necessary: The business landscape is constantly evolving. Being adaptable and willing to change course when necessary is essential for staying ahead of the curve and navigating unexpected challenges.

- Learn Continuously: Never Stop Growing: The pursuit of knowledge should be a lifelong endeavor. Continuously learning and developing new skills is crucial for staying competitive and adapting to changing market conditions.

- Develop a Growth Mindset: Embrace Challenges as Opportunities for Growth: A growth mindset, as opposed to a fixed mindset, embraces challenges as opportunities for growth and development. This allows you to learn from your mistakes, persevere through setbacks, and continuously improve.

- Delegate Wisely: Focus on Your Core Competencies: Trying to do everything yourself is a recipe for burnout and inefficiency. Delegating tasks to others allows you to focus on your core competencies and maximize your productivity.

- Maintain Work-Life Balance: Avoid Burnout: While dedication and hard work are essential for business success, maintaining a healthy work-life balance is crucial for avoiding burnout and sustaining long-term performance.

- Leverage Technology: Use Technology to Your Advantage: Technology offers a wealth of tools and resources that can help you streamline your operations, improve efficiency, and reach a wider audience. Embracing and leveraging technology is essential for staying competitive in today’s digital age.

- Plan Financially: Create a Budget and Stick to It: Creating a budget and sticking to it is crucial for managing your finances effectively and ensuring the long-term financial health of your business.

- Celebrate Milestones: Recognize Your Achievements: It’s important to take time to celebrate your milestones and recognize your achievements, both big and small. This helps to maintain motivation and reinforces positive momentum.

Conclusion:

A Journey, Not a Destination: Building a Legacy of Success

Mastering business is not a sprint; it’s a marathon—a lifelong journey of learning, adapting, and growing. It’s not about achieving instant riches or overnight fame; it’s about building something sustainable, something meaningful, something that leaves a lasting impact. By internalizing the timeless principles found within these five essential books, you’re not just acquiring business skills; you’re cultivating a mindset for success. You’re building a foundation for a fulfilling and prosperous future, not just for yourself, but potentially for generations to come.

This isn’t about becoming a millionaire overnight (though that might be a welcome side effect); it’s about developing the wisdom, the resilience, and the strategic thinking necessary to navigate the complexities of the business world and create a lasting legacy. This book has provided you with a powerful blueprint—a distillation of timeless wisdom. Now, the most important part begins: the execution. Go build. Go create. Go leave your mark on the world.

FAQ :

General Questions about the Book:

- Q: What is the main purpose of this book?

- A: This book is designed to provide a foundational understanding of key business principles by synthesizing the wisdom found in five essential business books. It’s a curated curriculum for aspiring entrepreneurs and business owners seeking a practical, time-tested approach to success.

- Q: Who is this book for?

- A: This book is ideal for:

- Aspiring entrepreneurs who are just starting their business journey.

- Small business owners looking to improve their business acumen.

- Anyone interested in learning core business principles through classic literature.

- Individuals seeking a concise and actionable approach to business education.

- A: This book is ideal for:

- Q: Are the full texts of the five books included in this book?

- A: No, this book provides summaries, key takeaways, examples, and exercises based on the core principles of each book. It encourages readers to explore the full texts for a deeper understanding.

- Q: In what order should I read the five books?

- A: While each chapter can be read independently, the book is structured in a way that builds upon previous concepts. Reading it from beginning to end is recommended for the most comprehensive learning experience.

- Q: How is this book different from other business books?

- A: This book takes a unique approach by synthesizing the wisdom of five classic texts, providing a concentrated dose of essential business principles. It focuses on practical application through examples and exercises, making the learning process more engaging and actionable.

Questions about the Featured Books and Concepts:

- Q: Why were these specific five books chosen?

- A: These books were selected because they cover a wide range of essential business principles, from financial literacy and mindset to strategy and productivity. They have stood the test of time and continue to be relevant in today’s business world.

- Q: What if I’ve already read some of these books?

- A: Even if you’ve read some of these books before, this book offers a fresh perspective by synthesizing their key concepts and providing practical exercises to help you apply them in a new way. It can serve as a valuable refresher and a catalyst for deeper understanding.

- Q: What is the difference between an asset and a liability (from Rich Dad, Poor Dad)?

- A: An asset puts money in your pocket, while a liability takes money out. For example, a rental property that generates income is an asset, while a car loan is a liability.

- Q: What is the “burning desire” concept from Think and Grow Rich?

- A: A burning desire is an intense, unwavering commitment to achieving your goals. It’s a powerful driving force that fuels your actions and sustains you through challenges.

- Q: What does The Millionaire Next Door teach about building wealth?

- A: It debunks the myth of the flashy millionaire and reveals that most millionaires accumulate their wealth through disciplined saving, investing, and living below their means.

- Q: How can The Art of War be applied to business?

- A: The Art of War offers timeless strategic principles that can be applied to business planning, competitor analysis, resource allocation, and navigating competitive landscapes.

- Q: What is the “eat that frog” concept from Eat That Frog!?

- A: The “eat that frog” metaphor encourages tackling the most challenging and important task first thing in the morning to overcome procrastination and maximize productivity.

Questions about Applying the Concepts:

- Q: How can I apply these principles if I don’t have a lot of money to invest?

- A: Many of these principles, such as financial literacy, goal setting, strategic thinking, and productivity, can be applied regardless of your current financial situation. Starting small and being consistent is key.

- Q: How much time should I dedicate to the exercises in this book?

- A: The exercises are designed to be practical and actionable. Dedicating even a few minutes each day or week to these exercises can make a significant difference in your understanding and application of the concepts.

- Q: Will reading this book guarantee my business success?

- A: While this book provides a valuable framework for understanding and applying key business principles, success is not guaranteed. It requires consistent effort, dedication, and adaptability. This book provides the tools; it’s up to you to use them.

Ebook Review: Mastering Business Through Five Essential Books

Index

Chapter 1: Mastering the Basics

Rich Dad, Poor Dad by Robert Kiyosaki

Chapter 2: Think and Grow Rich by Napoleon Hill

Core Principles:

You Are Responsible for Your Destiny:

Chapter 3: Lessons from The Millionaire Next Door

Essential Insights:

Frugality is Key:

Chapter 4: Strategic Thinking

The Art of War by Sun Tzu

Strategic Lessons:

Maximize Limited Resources:

Chapter 5: Productivity Hacks

Eat That Frog by Brian Tracy

Productivity Tips:

13 Vital Business Tips

- Start with a Vision:

- Invest in Financial Education:

- Focus on Execution:

- Build Strong Networks:

- Practice Frugality:

- Stay Adaptable:

- Learn Continuously:

- Develop a Growth Mindset:

- Delegate Wisely:

- Maintain Work-Life Balance:

- Leverage Technology:

- Plan Financially:

- Celebrate Milestones:

Conclusion

FAQs